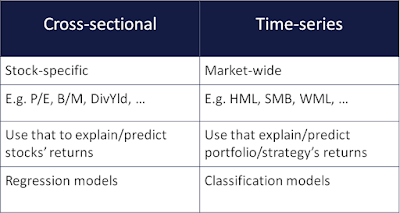

Introductory econometrics: a modern approach (4th ed.). "Part 1: Regression Analysis with Cross Sectional Data". "Cross-Section Regression with Common Shocks" (PDF). In a cross-asset strategy that is market neutral, the dominant. The rst factor is dominant and will resemble the market return. Suppose we do a principal components decompo-sition of a set of cash equity returns and extract the rst 10 factors. Consider the following motivating example. at one point in time, and different data points would be drawn on the same economy but at different points in time. di erent implementations: time-series vs. In contrast, a regression using time series would have as each data point an entire economy's money holdings, income, etc. A cross-sectional regression would have as each data point an observation on a particular individual's money holdings, income, and perhaps other variables at a single point in time, and different data points would reflect different individuals at the same point in time. Starting off the season with 6 straight draws and not scoring a whole lot in the 1st half of the season to finishing off the season extremely strongly with 5 wins in the last 8 games of the season and also scoring a bucket load of goals throughout the 2nd half with 4 games where Sapporo scored more than 4 goals. This type of cross-sectional analysis is in contrast to a time-series regression or longitudinal regression in which the variables are considered to be associated with a sequence of points in time.įor example, in economics a regression to explain and predict money demand (how much people choose to hold in the form of the most liquid assets) could be conducted with either cross-sectional or time series data. In statistics and econometrics, a cross-sectional regression is a type of regression in which the explained and explanatory variables are all associated with the same single period or point in time.

0 kommentar(er)

0 kommentar(er)